Ghatkopar East, a bustling suburb in Mumbai, offers a prime location and a plethora of residential and commercial options. However, before diving into the property market, it’s crucial to understand Ghatkopar East property rates. In this comprehensive guide, we will provide an overview of the location and address frequently asked questions related to property rates in Ghatkopar East.

Ghatkopar East Property Rates

Avg. Rate / sq.ft.

INR 12,375 – 44,176

Rental Yield

Approx. 4 – 7%

Growth in Last One Year

+6.4%

Ghatkopar Location Overview

Connectivity

Ghatkopar enjoys seamless connectivity to other parts of Mumbai. The suburb is well-connected through major roadways, including the Eastern Express Highway and Jogeshwari-Vikhroli Link Road (JVLR). Furthermore, the Ghatkopar Metro Station is a significant transportation hub connecting the area to various parts of the city via the Versova-Ghatkopar Metro Line.

Social Infrastructure

Over the years, Ghatkopar East has witnessed substantial infrastructure development, making it an ideal destination for property buyers. The suburb boasts numerous renowned schools, colleges, hospitals, shopping centres, and entertainment hubs, along with places of worship. This combined with the presence of commercial establishments makes Ghatkopar East an attractive proposition for residential and commercial investments.

Lifestyle and Amenities

Ghatkopar East offers a vibrant and cosmopolitan lifestyle, with a plethora of dining, entertainment, and shopping options. The presence of multiplexes, restaurants, and retail outlets caters to the diverse needs of residents, making it a self-sufficient locality. The famous R City Mall, with its beautifully landscaped gardens, provides an environment for recreation and relaxation.

Residential Options

Ghatkopar East offers a diverse range of residential properties to suit the needs and preferences of different buyers. From luxurious apartments to affordable housing schemes, the real estate market here caters to a wide range of budgets. The area is known for its well-designed, modern apartments equipped with state-of-the-art amenities, making it an ideal choice for families and working professionals.

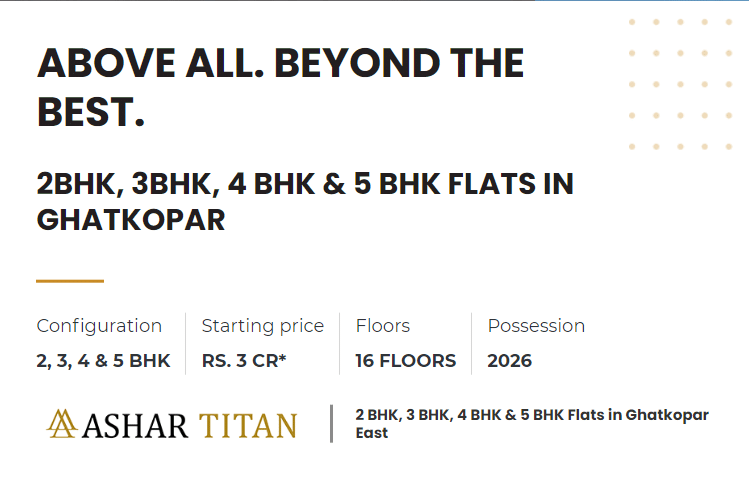

Best Property in Ghatkopar East

Ashar Titan is an exceptional residential project that offers Vastu compliant 2 BHK, 3 BHK, 4 BHK and 5 BHK homes in a 16-storey boutique tower. Situated in the prime location of Ghatkopar East. it provides easy access to shopping malls, healthcare facilities, educational institutions, and temples, all within a 2-kilometer radius. The property boasts an impeccably designed podium level amenity zone called 1 Above, which includes a kids play area, indoor games area, fully equipped gym, and a range of other amenities for the residents’ happiness. Additionally, residents can enjoy a rooftop amenity zone called Beyond 15, featuring a yoga and meditation deck, reflexology path, party deck, box cricket, and more. Furthermore, Ashar Titan also offers retail spaces ranging from 804 to 1128 sq.ft. carpet area starting 11 Cr onwards. It truly offers a delightful experience with a variety of lifestyle brands to the customers.

Investing in real estate is a big decision, and understanding property rates is crucial for making an informed choice. With its strategic location, well-developed infrastructure, and a range of residential and commercial options, Ghatkopar East presents a promising investment opportunity. By considering the factors discussed in this guide and conducting comprehensive market research, you can navigate the Ghatkopar East property market with confidence. Remember to consult with reputable real estate professionals for personalized advice tailored to your specific requirements and remember only to transact with brands that have a positive reputation.

Frequently Asked Question

What is the average property rate in Ghatkopar East?

Ghatkopar East’s property rates vary depending on various factors such as location, property type, amenities, and age of the building. As of February 2024, the average property rates in Ghatkopar East range between 12,375 – 44,176 per square feet (Source: Housing).

What is the average rental return in Ghatkopar East, Mumbai?

The average rental yield in Ghatkopar is about 4-7% (Source: which is quite competitive compared to the average residential rental yields.

How have the property rates in Ghatkopar East, Mumbai changed over the years?

The area has witnessed rapid urban development and infrastructure improvements, the demand for properties has surged, leading to a rise in prices of about 4-6% (Source: Housing & 99acres) in the past 01 year.

Is Ghatkopar East a good investment option?

Ghatkopar East has proven to be a lucrative investment option. With its strategic location, excellent connectivity, and robust infrastructure, the suburb continues to witness appreciation in property rates over the years. Moreover, the continuous development and upcoming projects make it a promising choice for investors.

Are there any upcoming infrastructure projects in Ghatkopar East?

Yes, the area is witnessing several upcoming infrastructure projects that will further enhance its connectivity and overall development. The Metro Line extension is set to provide seamless connectivity to various parts of Mumbai, making it an ideal time to invest in Ghatkopar East